Student loans are often the first major financial decision a student makes, and understanding them early can prevent long-term problems. This topic explains how student loans work in a clear and practical way, without using confusing financial terms. It helps students understand why education loans exist, who provides them, and what responsibilities come with borrowing money.

The guide focuses on how student loans support higher education in both the USA and India, despite differences in systems and rules. It highlights what students should think about before applying, such as total course cost, repayment timelines, and future income expectations. Instead of promoting fear or blind optimism, it encourages balanced decision-making.

This topic is especially useful for first-time borrowers who feel overwhelmed by loan options and paperwork. By understanding the basics early, students can avoid common misunderstandings and feel more confident about managing their education expenses responsibly.

What Is a Student Loan?

A student loan is money borrowed to pay for education expenses like tuition fees, books, accommodation, and sometimes daily living costs. Unlike scholarships or grants, student loans must be repaid, usually with interest, after your studies are completed.

In both the USA and India, student loans help students access higher education when family savings are not enough. While the systems differ, the basic idea remains the same: study now, repay later.

Types of Student Loans

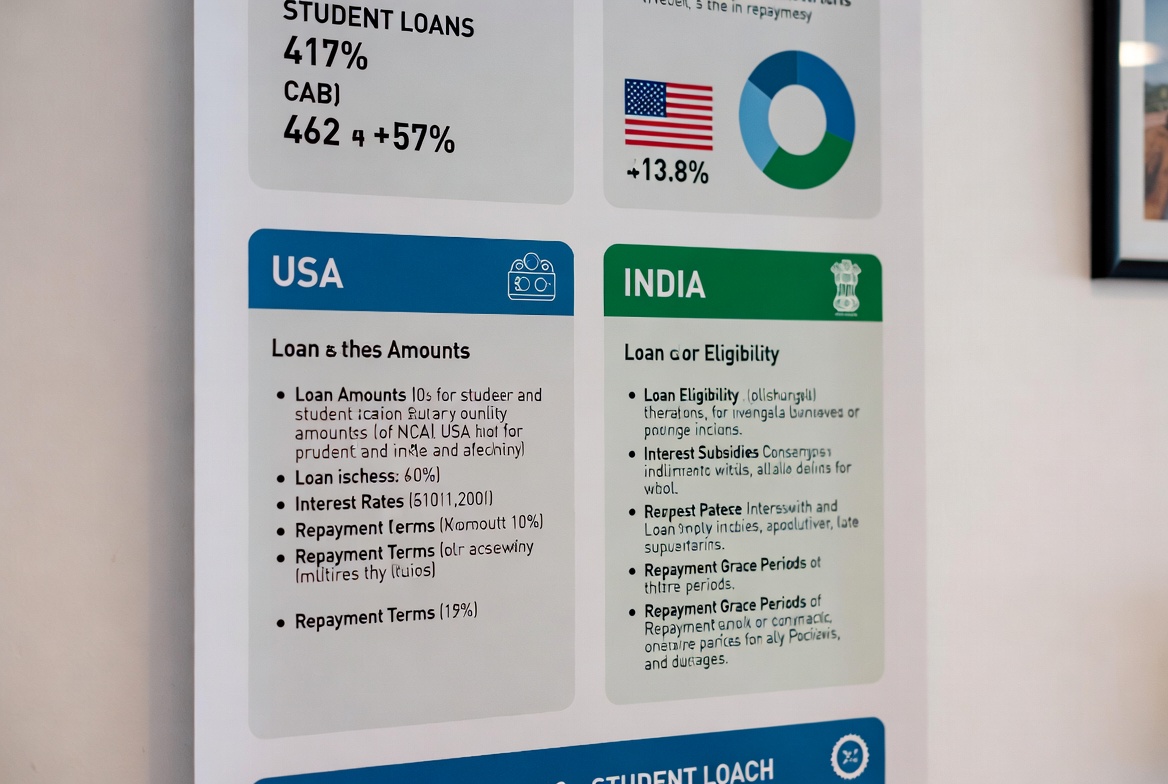

In the USA, student loans are mainly divided into federal loans and private loans. Federal loans are provided by the government and usually have lower interest rates and flexible repayment options. Private loans come from banks or financial institutions and depend heavily on your credit score.

In India, student loans are mostly provided by public and private banks. These loans are often backed by government schemes and usually require a co-applicant, such as a parent or guardian.

Interest Rates and How They Work

Interest is the extra amount you pay over the borrowed money. In the USA, federal loan interest rates are usually fixed and decided by the government. Private loans may have variable rates.

In India, interest rates are generally linked to bank lending rates and may change over time. Some banks offer lower rates for students from top institutions or for female students.

When Do You Start Repaying?

Most student loans offer a grace period. In the USA, repayment usually begins six months after graduation. In India, repayment often starts one year after course completion or six months after getting a job, whichever comes earlier.

Understanding this timeline helps students plan their finances better and avoid missed payments.

Is a Student Loan a Good Idea?

A student loan can be a smart investment if it leads to better career opportunities and income. However, borrowing more than necessary can create financial stress later. Students should calculate expected expenses carefully and borrow only what they truly need.