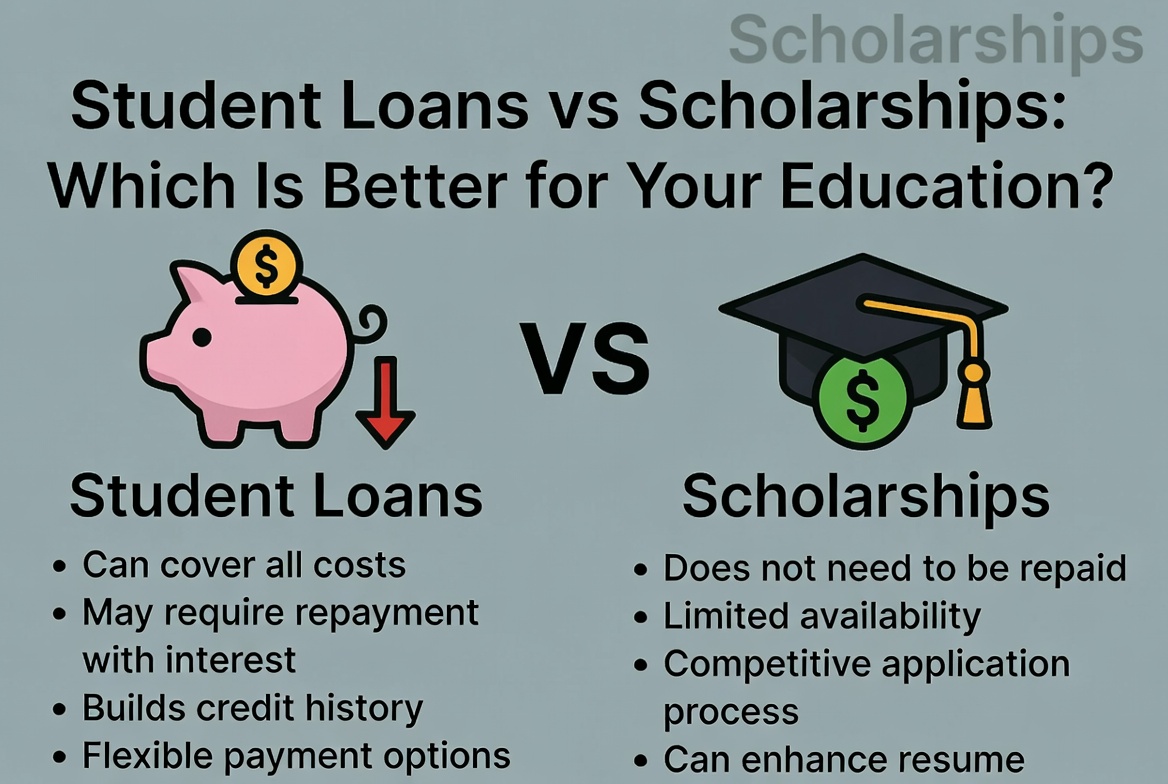

Choosing between student loans and scholarships is not always straightforward. This topic explains the real differences between the two and why one option is not automatically better than the other. It helps students understand the benefits and limitations of each funding source in practical terms.

The focus is on decision-making rather than comparison alone. Scholarships reduce financial burden but are limited and competitive, while loans provide access but require repayment. This topic encourages students to evaluate their academic profile, financial background, and career goals before choosing.

It also highlights how combining scholarships with smaller loans can reduce overall debt. This balanced approach helps students avoid extremes and build a funding plan that supports education without creating unnecessary financial pressure later.

Understanding Scholarships

Scholarships are financial awards that do not need to be repaid. They are usually based on merit, need, sports, or specific talents. Both the USA and India offer government and private scholarships for students.

The biggest advantage of scholarships is zero repayment stress.

Limitations of Scholarships

While scholarships are ideal, they are limited and highly competitive. Many scholarships cover only tuition and not living expenses. This is where student loans often fill the gap.

Relying only on scholarships may not always be realistic.

When student loans vs scholarships

Student loans provide immediate access to education without waiting for approvals or selection processes. For professional courses like engineering, medicine, or overseas education, loans are often the only practical option.

In both countries, loans allow students from middle-income families to pursue high-cost education.

Combining Both Options

The smartest approach is often a combination. Use scholarships to reduce your total education cost and take a smaller loan for the remaining expenses. This reduces your repayment burden after graduation.

Many successful students use this hybrid strategy.

Making the Right Choice

The right option depends on your academic profile, financial background, and career goals. Scholarships reduce risk, while loans increase access. Understanding both helps you make a confident decision.