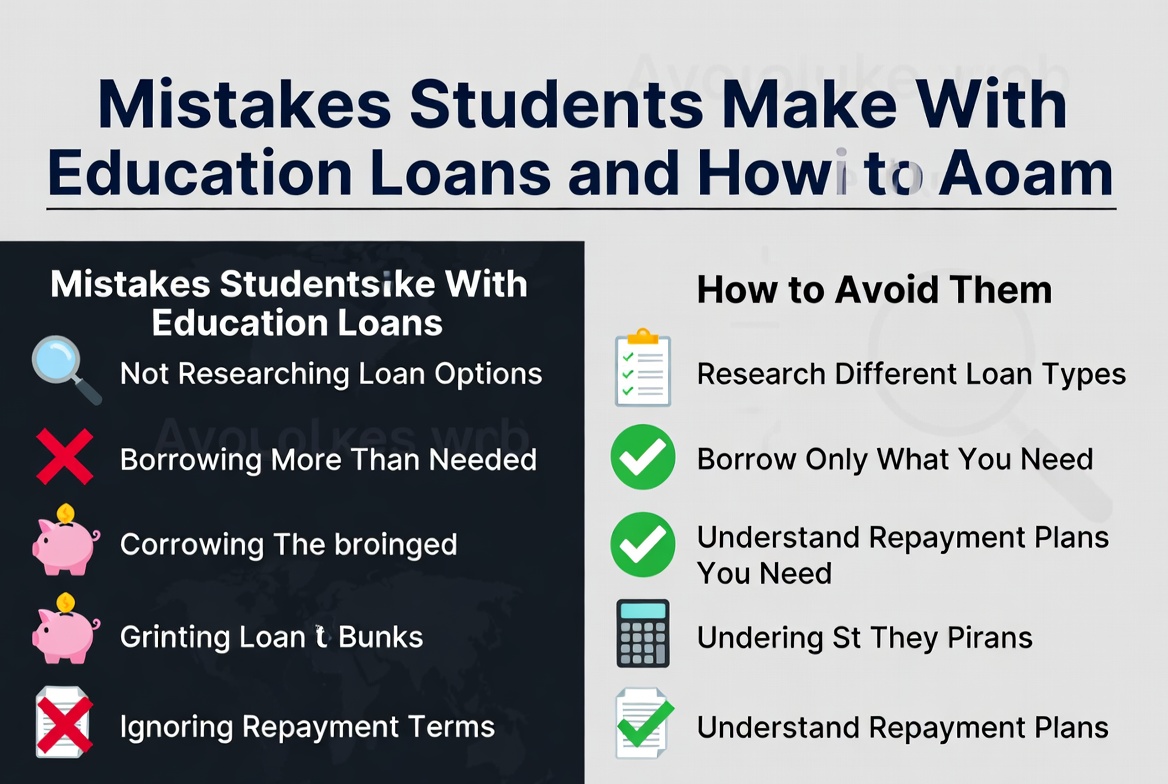

Many student loan problems start not after graduation, but at the time of borrowing. This topic identifies common mistakes students make when taking education loans and explains how these errors affect long-term finances. It focuses on awareness rather than blame.

Mistakes such as borrowing without planning, ignoring repayment terms, or assuming guaranteed high income are discussed in a realistic way. The topic explains how these habits can lead to stress, delayed goals, and financial instability.

By understanding these mistakes early, students can make smarter choices and avoid regret later. The goal is to help borrowers become responsible and informed, so education loans remain a support tool rather than a lifelong burden.

Borrowing Without a Clear Plan

One common mistake is borrowing the maximum amount without calculating actual needs. This leads to unnecessary debt and higher interest payments later.

Always estimate tuition, living costs, and emergency expenses realistically.

Ignoring Interest During Study Period

Many students ignore interest accumulation during their study years. In India, interest may start immediately, while in the USA it depends on loan type.

Paying interest early, even partially, can significantly reduce long-term burden.

Not Reading Loan Terms Carefully

Loan agreements include details about interest rates, penalties, prepayment rules, and moratorium periods. Skipping these details can lead to surprises later.

Spend time understanding the terms before signing.

Depending Fully on Future Income

Assuming a high-paying job immediately after graduation is risky. Job markets can change. Always plan repayments based on conservative income estimates.

A realistic approach prevents financial shock.

How to Avoid These Mistakes

Ask questions, compare lenders, and take advice from financial counselors if available. A student loan is a long-term commitment, and informed decisions make all the difference.